Fraud Surveillance Intelligence Compliance Oversight Unit 3286965186 3295353086 3384800703 3756232303 3510077494 3516659907

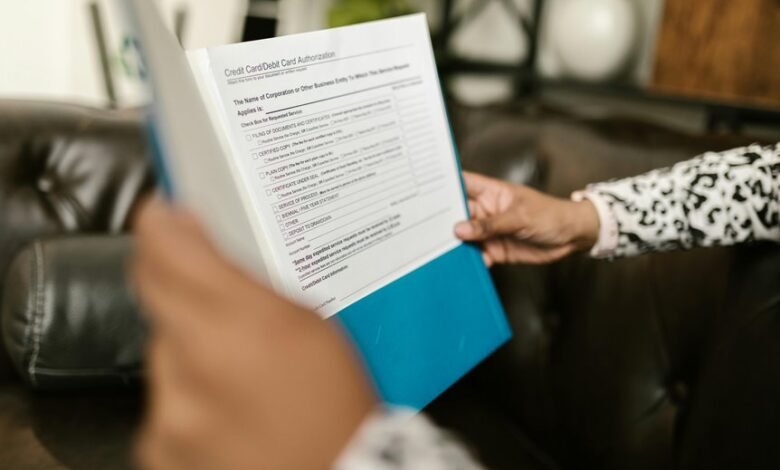

The Fraud Surveillance Intelligence Compliance Oversight Unit operates with a clear mandate to combat fraudulent activities within financial organizations. Utilizing advanced data analytics and behavioral profiling, it identifies anomalies that may indicate fraud. The unit emphasizes the critical need for intelligence sharing among entities to enhance detection capabilities. As compliance measures evolve, the ongoing challenge remains: how can organizations effectively adapt to the rising sophistication of fraud risks in an ever-changing landscape?

Objectives of the Fraud Surveillance Intelligence Compliance Oversight Unit

The primary objective of the Fraud Surveillance Intelligence Compliance Oversight Unit is to establish a robust framework for identifying, monitoring, and mitigating fraudulent activities within an organization.

This includes assessing fraud risk and implementing comprehensive compliance training programs.

Methodologies Employed for Fraud Detection and Prevention

Building on the framework established by the Fraud Surveillance Intelligence Compliance Oversight Unit, various methodologies are employed to detect and prevent fraudulent activities.

Data analytics plays a crucial role, enabling the identification of anomalies within transaction patterns.

Concurrently, behavioral profiling enhances understanding of typical customer behaviors, allowing for the swift recognition of deviations that may indicate fraudulent intentions, thus fostering a proactive compliance environment.

The Importance of Intelligence Sharing in Fraud Prevention

Collaboration among organizations is essential for effective fraud prevention, as intelligence sharing fosters a more comprehensive understanding of emerging threats.

By leveraging data analytics within collaborative networks, entities can enhance their detection capabilities and respond proactively to fraudulent activities.

This synergy not only improves individual organizational resilience but also fortifies the broader financial ecosystem against evolving risks and vulnerabilities associated with fraud.

Strengthening Compliance Measures to Safeguard Financial Integrity

Effective fraud prevention not only relies on intelligence sharing but also necessitates robust compliance measures to uphold financial integrity.

Strengthening compliance involves comprehensive risk assessments and adherence to regulatory frameworks, enabling organizations to identify vulnerabilities and implement effective controls.

Conclusion

In conclusion, the Fraud Surveillance Intelligence Compliance Oversight Unit exemplifies the adage, “An ounce of prevention is worth a pound of cure.” By implementing advanced methodologies for fraud detection and fostering intelligence sharing, the unit not only enhances compliance measures but also fortifies the financial ecosystem against emerging threats. This proactive approach is essential for safeguarding financial integrity and building resilience, ultimately ensuring that organizations can effectively mitigate fraud risks and maintain trust within the industry.