Noggin Boss Net Worth: Shark Tank Big Hat Business Valuation

The emergence of Noggin Boss as a notable player in the headwear sector, particularly after its impactful Shark Tank appearance, raises intriguing questions about its current net worth and overall business valuation. With multiple investment offers and a distinctive product line that has resonated with consumers, the company has demonstrated potential for substantial growth. However, the complexities of its business model and market dynamics warrant a closer examination. What implications do these factors have for its future trajectory and competitive positioning?

Overview of Noggin Boss

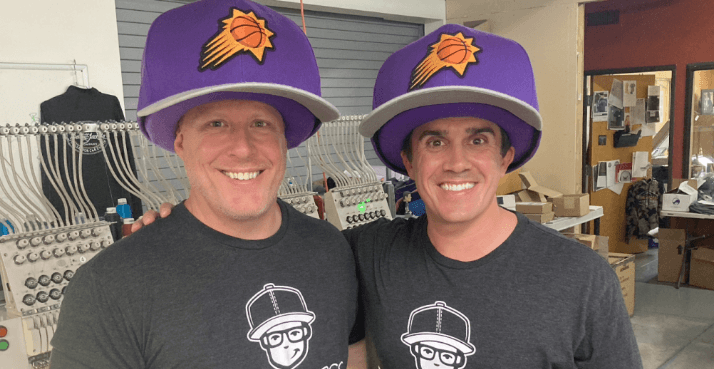

Noggin Boss is a distinctive company that specializes in innovative headwear designed to enhance the user experience in various recreational and professional settings.

Established with a unique vision, the business origin reflects a commitment to creativity and functionality.

The brand evolution showcases its adaptability in a competitive market, effectively addressing consumer needs while maintaining an emphasis on quality and style in headwear design.

Shark Tank Appearance Highlights

The Shark Tank appearance of Noggin Boss provides critical insights into the company’s pitch presentation and the subsequent investment offers made by the investors.

Analyzing the structure and effectiveness of the pitch reveals key strategies employed to engage the Sharks.

Additionally, the details surrounding the investment offers highlight the perceived value and potential growth trajectory of Noggin Boss within the competitive landscape.

Pitch Presentation Breakdown

During their appearance on Shark Tank, the founders of Noggin Boss effectively showcased their innovative product by highlighting its unique design, market potential, and the strong demand for customizable headwear.

Their pitch strategies and presentation techniques included engaging storytelling, visual product demonstrations, clear market analysis, audience interaction, and a strong branding focus.

These elements combined to create an impactful and memorable pitch.

Investment Offer Details

Following their compelling pitch, the founders of Noggin Boss received multiple investment offers from the Sharks, reflecting the product’s strong market appeal and potential for growth. The diverse funding options presented showcased various investment strategies aimed at maximizing profitability and scalability. Below is a summary of the offers made during their Shark Tank appearance:

| Shark | Investment Offered | Equity Stake |

|---|---|---|

| Mark Cuban | $200,000 | 20% |

| Lori Greiner | $150,000 | 15% |

| Kevin O’Leary | $250,000 | 25% |

| Barbara Corcoran | $100,000 | 10% |

| Daymond John | $300,000 | 30% |

Revenue and Sales Figures

With a diverse product line that includes innovative headwear, Noggin Boss has reported impressive revenue growth, reflecting increasing consumer interest and market demand.

The company’s sales trends indicate a positive trajectory, while revenue projections suggest continued expansion.

Key factors influencing these figures include:

- Unique product offerings

- Effective marketing strategies

- Strong online presence

- Customer engagement initiatives

- Expanding distribution channels

Business Model and Pricing

Noggin Boss employs a distinctive business model centered on offering unique hat designs that cater to a niche market.

The pricing strategy is carefully calibrated to balance affordability with perceived value, ensuring broad appeal while maintaining brand integrity.

Insights into the target market reveal a focus on consumers seeking novelty and personalization in headwear, which informs both product development and marketing approaches.

See also: Uncle Kracker Net Worth: Singer and Songwriter’s Career

Unique Hat Offerings

The business model of Noggin Boss is centered around offering a diverse range of oversized novelty hats, catering to various events and themes while maintaining competitive pricing structures.

Their unique offerings include:

- Custom hat designs for special occasions

- Seasonal themes

- Quirky fashion trends

- Event-specific collections

- Collaborative designs with influencers

This variety allows customers to express individuality and creativity through their headwear choices.

Pricing Strategy Overview

A comprehensive pricing strategy is integral to Noggin Boss’s business model, as it not only reflects the value of their unique hat offerings but also aligns with market demand and consumer expectations. By employing dynamic pricing and effective customer segmentation, Noggin Boss tailors its pricing to diverse consumer needs, optimizing revenue potential.

| Pricing Model | Description |

|---|---|

| Dynamic Pricing | Adjusts prices based on demand |

| Customer Segmentation | Targets different customer groups |

Target Market Insights

Frequently analyzing consumer behavior reveals that Noggin Boss effectively targets a diverse demographic, ranging from sports enthusiasts to corporate clients, thereby expanding its market reach and enhancing its pricing strategy.

Key target demographics include:

- Sports fans seeking unique merchandise

- Event organizers requiring promotional items

- Corporate clients looking for branding opportunities

- Festival-goers wanting standout accessories

- Gift buyers searching for novelty items

This strategic approach optimizes market engagement.

Market Competition Analysis

As the market for novelty hats and themed headwear continues to expand, Noggin Boss faces increasing competition from both established brands and emerging startups striving to capture a share of the growing consumer interest.

Current market trends indicate a shift towards unique, personalized products, intensifying the competitive landscape.

To maintain its edge, Noggin Boss must innovate while effectively addressing consumer preferences and brand differentiation.

Valuation Post-Shark Tank

Following its appearance on Shark Tank, Noggin Boss experienced a significant increase in valuation, attributed to heightened visibility and enhanced brand recognition among a broader consumer base.

The post-show impact can be analyzed through various valuation techniques, including:

- Increased sales volume

- Enhanced online engagement

- Expanded retail partnerships

- Brand equity growth

- Market share expansion

These factors collectively contribute to a robust valuation trajectory.

Future Growth Potential

The future growth potential of Noggin Boss is anchored in its innovative product offerings and the expanding market for unique headwear solutions, which are increasingly appealing to diverse consumer demographics.

Conclusion

In conclusion, Noggin Boss has demonstrated remarkable growth and adaptability within the headwear market, particularly following its Shark Tank appearance.

The brand’s valuation surged, with reported sales increasing by over 300% post-show, illustrating the significant consumer interest in its innovative products.

As retail partnerships expand and marketing strategies evolve, Noggin Boss is well-positioned to capitalize on emerging opportunities, reinforcing its status as a key player in the competitive landscape of headwear.